Multiple Choice

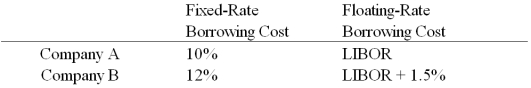

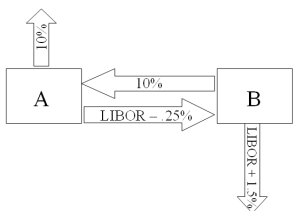

Compute the payments due in the second year on a three-year AMORTIZING swap from company B to company A) Company A and company B both want to borrow £1,000,000 for three years.A wants to borrow floating and B wants to borrow fixed.A and B agree to split the QSD.

A) B pays £402,114.80 to A

B) B pays £100,000 to A

C) B pays £69,788.52 to A

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What would be the interest rate?

Q2: What would be the interest rate?

Q40: Explain how firm A could use two

Q47: Examples of "single-currency interest rate swap" and

Q51: The term interest rate swap<br>A)refers to a

Q56: FOR YOUR SWAP (the one you have

Q60: Suppose that you are a swap bank

Q66: Company X wants to borrow $10,000,000 floating

Q97: Consider a fixed for fixed currency swap.

Q98: In the problem just previous, company X<br>A)is