Essay

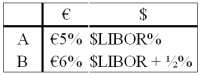

Come up with a swap (exchange of interest and principal)for parties A and B who have the following borrowing opportunities.  The current exchange rate is $1.60 = €1.00.Company "A" is in Milan,Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S.firm that wants to borrow €625,000 for 5 years at a fixed rate of interest.You are a swap dealer.Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B.

The current exchange rate is $1.60 = €1.00.Company "A" is in Milan,Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S.firm that wants to borrow €625,000 for 5 years at a fixed rate of interest.You are a swap dealer.Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: A major risk faced by a swap

Q43: Company X wants to borrow $10,000,000 floating

Q44: Suppose that you are a swap bank

Q49: Devise a direct swap for A and

Q60: Explain how this opportunity affects which swap

Q60: Explain how this opportunity affects which swap

Q80: Swaps are said to offer market completeness<br>A)This

Q84: Explain how firm B could use the

Q87: Consider a plain vanilla interest rate swap.

Q96: Nominal differences in currency swaps<br>A)can be explained