Multiple Choice

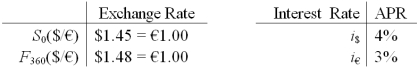

Suppose you observe the following 1-year interest rates,spot exchange rates and futures prices.Futures contracts are available on €10,000.How much risk-free arbitrage profit could you make on 1 contract at maturity from this mispricing?

A) $159.22

B) $153.10

C) $439.42

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: Suppose the futures price is below the

Q44: The same call from the last question

Q46: Find the dollar value today of a

Q68: The current spot exchange rate is $1.55

Q73: Draw the tree for a put option

Q74: If the call finishes out-of-the-money what is

Q74: Exercise of a currency futures option results

Q75: Assume that the dollar-euro spot rate is

Q83: You have written a call option on

Q86: Find the risk neutral probability of an