Multiple Choice

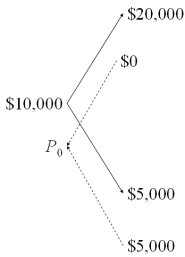

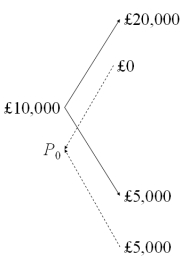

Draw the tree for a put option on $20,000 with a strike price of £10,000.The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half.The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: In which market does a clearinghouse serve

Q6: A CME contract on €125,000 with September

Q44: The same call from the last question

Q46: Find the dollar value today of a

Q54: Verify that the dollar value of your

Q68: The current spot exchange rate is $1.55

Q70: Suppose you observe the following 1-year interest

Q75: Assume that the dollar-euro spot rate is

Q83: You have written a call option on

Q86: Find the risk neutral probability of an