Multiple Choice

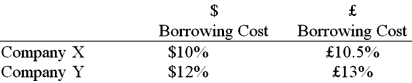

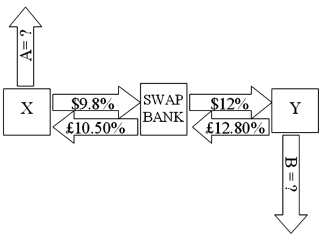

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years. The exchange rate is $2 = £1 and is not expected to change over the next 5 years. Their external borrowing opportunities are:  A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.

A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.  If company X takes on the swap, what external actions should they engage in?

If company X takes on the swap, what external actions should they engage in?

A) They should borrow $10,000,000 at $10%.

B) They should borrow £5,000,000 at 10.50% interest-only for five years; translate pounds to dollars at the spot rate.

C) They should borrow £5,000,000 at £10.50% interest-only for five years; translate pounds to dollars at the spot rate; enter long position in a forward contract to buy £5,000,000 in five years.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Company X wants to borrow $10,000,000 floating

Q40: Explain how firm A could use two

Q42: A major risk faced by a swap

Q43: Act as a swap bank and quote

Q45: Devise a direct swap for A and

Q46: Company X wants to borrow $10,000,000 floating

Q47: Examples of "single-currency interest rate swap" and

Q48: Consider the borrowing rates for Parties A

Q96: Nominal differences in currency swaps<br>A)can be explained

Q100: You are the debt manager for a