Multiple Choice

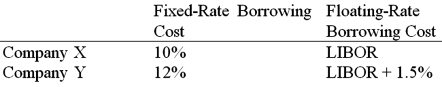

Company X wants to borrow $10,000,000 floating for 5 years. Company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are:  Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

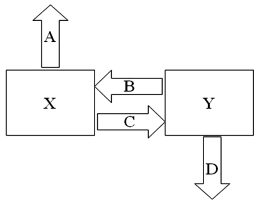

Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

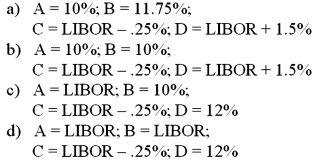

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q42: A major risk faced by a swap

Q43: Act as a swap bank and quote

Q44: Company X wants to borrow $10,000,000 floating

Q45: Devise a direct swap for A and

Q47: Examples of "single-currency interest rate swap" and

Q48: Consider the borrowing rates for Parties A

Q50: Come up with a swap (exchange of

Q51: The term interest rate swap<br>A)refers to a

Q96: Nominal differences in currency swaps<br>A)can be explained

Q100: You are the debt manager for a