Essay

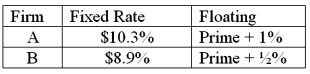

Consider the borrowing rates for Parties A andB. A wants to finance a $100,000,000 project at a FIXED rate. B wants to finance a $100,000,000 project at a FLOATING rate. Both firms want the same maturity, 5 years.

Correct Answer:

Verified

_TB2454_00 Construct a mutuall...

_TB2454_00 Construct a mutuall...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Act as a swap bank and quote

Q44: Company X wants to borrow $10,000,000 floating

Q45: Devise a direct swap for A and

Q46: Company X wants to borrow $10,000,000 floating

Q47: Examples of "single-currency interest rate swap" and

Q50: Come up with a swap (exchange of

Q51: The term interest rate swap<br>A)refers to a

Q52: Pricing a currency swap after inception involves<br>A)finding

Q53: Company X wants to borrow $10,000,000 floating

Q100: You are the debt manager for a