Multiple Choice

Compute the payments due in the second year on a three-year AMORTIZING swap from company B to company

A) B pays £402,114.80 to A

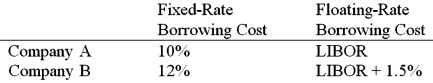

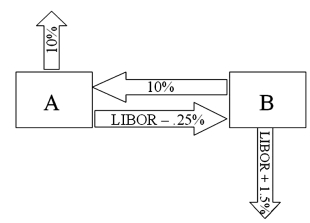

A) Company A and company B both want to borrow £1,000,000 for three years. A wants to borrow floating and B wants to borrow fixed. A and B agree to split the QSD.

B) B pays £100,000 to A

C) B pays £69,788.52 to A

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Suppose that you are a swap bank

Q67: A major risk faced by a swap

Q68: Suppose the quote for a five-year swap

Q69: Company X wants to borrow $10,000,000 floating

Q71: Explain how firm A could use the

Q72: Act as a swap bank and quote

Q73: Find the all-in-cost of a swap to

Q74: Company X wants to borrow $10,000,000 floating

Q75: Explain how firm A could use the

Q90: Explain how this opportunity affects which swap