Multiple Choice

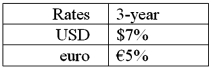

Suppose that you are a swap bank and you notice that interest rates on coupon bonds are as shown. Develop the 3-year bid price of a euro swap quoted against flat USD LIBOR. The current spot exchange rate is $1.50 per €1.00. The size of the swap is €40 million versus $60 million.  In other words, what you be willing to pay in euro against receiving USD LIBOR?

In other words, what you be willing to pay in euro against receiving USD LIBOR?

A) 7%

B) 6%

C) 5%

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q61: A major risk faced by a swap

Q62: In a currency swap<br>A)it may be the

Q63: An interest-only currency swap has a remaining

Q64: Company X wants to borrow $10,000,000 floating

Q67: A major risk faced by a swap

Q68: Suppose the quote for a five-year swap

Q69: Company X wants to borrow $10,000,000 floating

Q70: Compute the payments due in the second

Q71: Explain how firm A could use the

Q90: Explain how this opportunity affects which swap