Multiple Choice

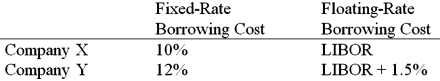

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of rate of 9.90%.in exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of rate of 9.90%.in exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

A) Company Y will save 15 basis points per year on $10,000,000 = $15,000 per year.

B) Company Y will save 45 basis points per year on $10,000,000 = $45,000 per year.

C) Company Y will save 5 basis points per year on $10,000,000 = $5,000 per year.

D) Company Y will only break even on the deal.

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Company X wants to borrow $10,000,000 floating

Q66: Suppose that you are a swap bank

Q67: A major risk faced by a swap

Q68: Suppose the quote for a five-year swap

Q70: Compute the payments due in the second

Q71: Explain how firm A could use the

Q72: Act as a swap bank and quote

Q73: Find the all-in-cost of a swap to

Q74: Company X wants to borrow $10,000,000 floating

Q90: Explain how this opportunity affects which swap