Multiple Choice

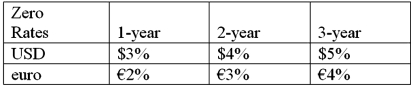

Suppose that you are a swap bank and you notice that interest rates on zero coupon bonds are as shown. Develop the 3-year bid price of a dollar swap quoted against flat USD LIBOR.  In other words, what you be willing to pay in euro against receiving USD LIBOR?

In other words, what you be willing to pay in euro against receiving USD LIBOR?

A) 5%

B) 4%

C) 3%

D) 2%

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Come up with a swap (exchange of

Q51: The term interest rate swap<br>A)refers to a

Q52: Pricing a currency swap after inception involves<br>A)finding

Q53: Company X wants to borrow $10,000,000 floating

Q56: FOR YOUR SWAP (the one you have

Q57: Devise a direct swap for A and

Q58: The size of the swap market is<br>A)measured

Q59: Pricing an interest-only single currency swap after

Q82: Which combination of the following represent the

Q100: You are the debt manager for a