Essay

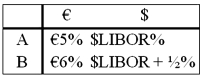

Come up with a swap (exchange of interest and principal) for parties A and B who have the following borrowing opportunities.  The current exchange rate is $1.60 = €1.00. Company "A" is in Milan, Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S. firm that wants to borrow €625,000 for 5 years at a fixed rate of interest. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B

The current exchange rate is $1.60 = €1.00. Company "A" is in Milan, Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S. firm that wants to borrow €625,000 for 5 years at a fixed rate of interest. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Devise a direct swap for A and

Q46: Company X wants to borrow $10,000,000 floating

Q47: Examples of "single-currency interest rate swap" and

Q48: Consider the borrowing rates for Parties A

Q51: The term interest rate swap<br>A)refers to a

Q52: Pricing a currency swap after inception involves<br>A)finding

Q53: Company X wants to borrow $10,000,000 floating

Q54: Suppose that you are a swap bank

Q82: Which combination of the following represent the

Q100: You are the debt manager for a