Multiple Choice

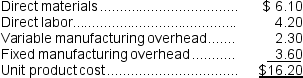

Gallerani Corporation has received a request for a special order of 6,000 units of product A90 for $21.20 each.Product A90's unit product cost is $16.20, determined as follows:  Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

A) $(18,600)

B) $(16,200)

C) $30,000

D) $5,400

Correct Answer:

Verified

Correct Answer:

Verified

Q27: A complete income statement need not be

Q138: Two or more products that are produced

Q167: Younes Inc. manufactures industrial components. One of

Q185: Gordon Corporation produces 1,000 units of a

Q186: Vanik Corporation currently has two divisions which

Q189: Consider the following production and cost data

Q192: McGraw Company uses 5,000 units of Part

Q193: Garson, Inc.produces three products.Data concerning the selling

Q231: In a decision to drop a product,

Q402: A study has been conducted to determine