Essay

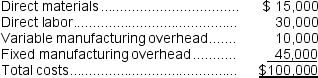

McGraw Company uses 5,000 units of Part X each year as a component in the assembly of one of its products.The company is presently producing Part X internally at a total cost of $100,000, computed as follows:  An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

Required:

Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

Correct Answer:

Verified

_TB2627_00 * 1/3 × $...

_TB2627_00 * 1/3 × $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: A complete income statement need not be

Q36: The Carter Corporation makes products A and

Q97: The Carter Corporation makes products A and

Q167: Younes Inc. manufactures industrial components. One of

Q188: Gallerani Corporation has received a request for

Q189: Consider the following production and cost data

Q193: Garson, Inc.produces three products.Data concerning the selling

Q195: WP Corporation produces products X, Y, and

Q282: A disadvantage of vertical integration is that

Q402: A study has been conducted to determine