Essay

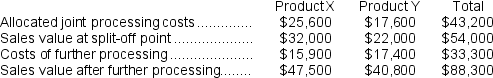

Ibsen Company makes two products from a common input.Joint processing costs up to the split-off point total $43,200 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  Required:

Required:

a.What is financial advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is financial advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

a.& b.  _TB...

_TB...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Melbourne Corporation has traditionally made a subcomponent

Q62: Costs that can be eliminated in whole

Q72: The Bharu Violin Corporation has the capacity

Q80: Part U16 is used by Mcvean Corporation

Q82: The Jabba Corporation manufactures the "Snack Buster"

Q83: Zouar Computer Corporation currently manufactures the disk

Q86: What is the financial advantage (disadvantage)for the

Q150: Bertucci Corporation makes three products that use

Q172: Elly Industries is a multi-product company that

Q432: Hamby Corporation is preparing a bid for