Multiple Choice

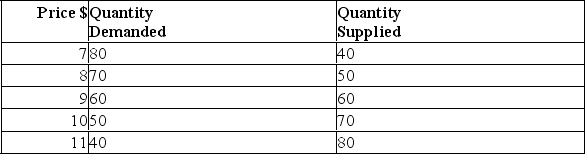

-Refer to the information above to answer this question.If the government imposes a $2 per unit sales tax on this product,how much of that tax will consumers pay and how much will sellers pay?

A) Consumers will pay all $2 of the tax.

B) Consumers will pay $1.50 and sellers $.50.

C) Consumers and sellers will each pay $1.

D) Consumers will pay $.50 and seller $1.50.

E) Sellers will pay all $2 of the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: If a product has many substitutes,which of

Q32: What is price elasticity of demand?<br>A)The responsiveness

Q33: Suppose that the price of a product

Q34: What does the term elastic demand mean?<br>A)Quantities

Q35: The graph below shows the supply and

Q37: What does the elasticity coefficient refer to?<br>A)It

Q38: According to Alfred Marshall,time plays a critical

Q39: The graph below illustrates three demand curves.<br>

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5692/.jpg" alt=" -Refer to the

Q41: The list below refers to the price