Multiple Choice

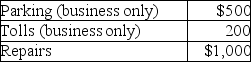

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2017.This represents about 75% of the auto's use.She has receipts as follows:  Brittany's AGI for the year is $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year is $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

A) $10,400.

B) $12,400.

C) $11,400.

D) $9,700.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Avantra Inc.is a professional firm with the

Q2: In determining whether travel expenses are deductible,a

Q5: Personal travel expenses are deductible as miscellaneous

Q6: Characteristics of profit-sharing plans include all of

Q8: Richard traveled from New Orleans to New

Q10: Steven is a representative for a textbook

Q11: Martin Corporation granted a nonqualified stock option

Q85: A sole proprietor will not be allowed

Q602: Jack takes a $7,000 distribution from his

Q1643: Johanna is single and self- employed as