Multiple Choice

Use the following information to answer the question(s) below.

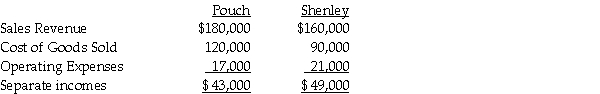

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1,2012,when the book values of Shenley's assets and liabilities were equal to their fair values.The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets.During 2012,Pouch sold merchandise that cost $70,000 to Shenley for $86,000.On December 31,2012,three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory.Separate incomes (investment income not included) of the two companies are as follows:

-The consolidated income statement for Pouch Corporation and subsidiary for the year ended December 31,2012 will show consolidated cost of sales of

A) $120,000.

B) $136,000.

C) $148,000.

D) $210,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: On January 1,2011,Paar Incorporated paid $38,500 for

Q9: Use the following information to answer the

Q11: Preen Corporation acquired a 60% interest in

Q12: Use the following information to answer the

Q14: Papal Corporation acquired an 80% interest in

Q15: Paulee Corporation paid $24,800 for an 80%

Q16: Proman Manufacturing owns a 90% interest in

Q17: Phast Corporation owns a 80% interest in

Q18: Plateau Incorporated bought 60% of the common

Q25: Assume there are routine inventory sales between