Essay

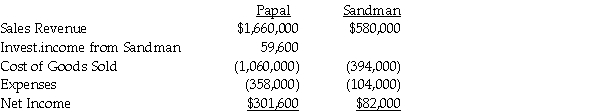

Papal Corporation acquired an 80% interest in Sandman Corporation at a cost equal to 80% of the book value of Sandman's net assets in 2010.At the time of the acquisition,the book values and fair values of Sandman's assets and liabilities were equal.During 2011,Papal recorded sales of $440,000 of merchandise to Sandman at a gross profit rate of 30%.Sandman's beginning and ending inventories for 2011 were $60,000 and $80,000,respectively.Income statement information for both companies for 2011 is as follows:

Required:

Required:

Prepare a consolidated income statement for Papal Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Use the following information to answer the

Q11: Preen Corporation acquired a 60% interest in

Q12: Use the following information to answer the

Q13: Use the following information to answer the

Q15: Paulee Corporation paid $24,800 for an 80%

Q16: Proman Manufacturing owns a 90% interest in

Q17: Phast Corporation owns a 80% interest in

Q18: Plateau Incorporated bought 60% of the common

Q19: Use the following information to answer the

Q25: Assume there are routine inventory sales between