Essay

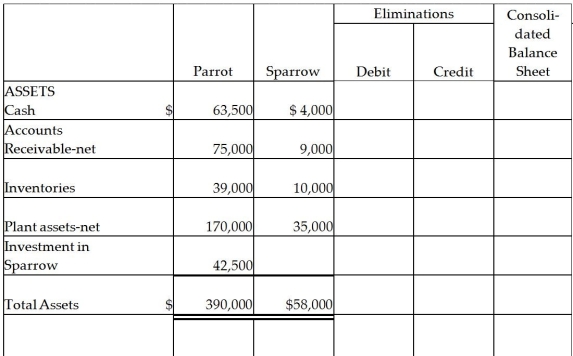

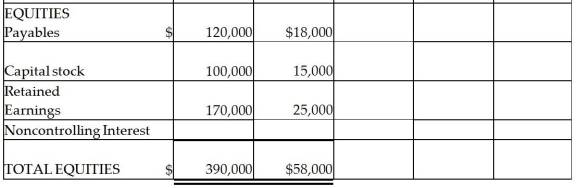

Parrot Inc.acquired an 85% interest in Sparrow Corporation on January 2,2011 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000.Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000.Balance sheets for Parrot and Sparrow on January 2,2011,immediately after the business combination,are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1,2011.

Correct Answer:

Verified

_TB1535_00...

_TB1535_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: A subsidiary can be excluded from consolidation

Q8: Pool Industries paid $540,000 to purchase 75%

Q9: Petra Corporation paid $500,000 for 80% of

Q10: The consolidated balance sheet of Pasker Corporation

Q11: On January 2,2011,Power Incorporated paid $630,000 for

Q13: Patterson Company acquired 90% of Starr Corporation

Q14: On January 1,2011,Parry Incorporated paid $72,000 cash

Q15: On January 1,2005,Myna Corporation issued 10,000 shares

Q17: Perth Corporation acquired a 100% interest in

Q45: Subsequent to an acquisition,the parent company and