Essay

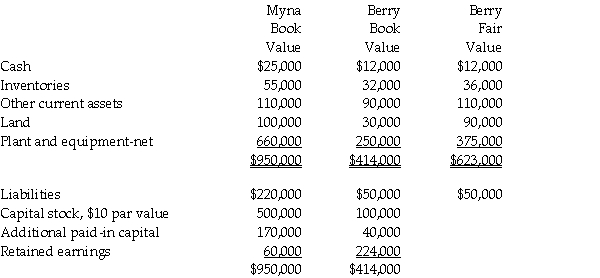

On January 1,2005,Myna Corporation issued 10,000 shares of its own $10 par value common stock for 9,000 shares of the outstanding stock of Berry Corporation in an acquisition.Myna common stock at January 1,2005 was selling at $70 per share.Just before the business combination,balance sheet information of the two corporations was as follows:

Required:

Required:

1.Prepare the journal entry on Myna Corporation's books to account for the investment in Berry Company.

2.Prepare a consolidated balance sheet for Myna Corporation and Subsidiary immediately after the business combination.

Correct Answer:

Verified

_TB1535_00...

_TB1535_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: A subsidiary can be excluded from consolidation

Q10: The consolidated balance sheet of Pasker Corporation

Q11: On January 2,2011,Power Incorporated paid $630,000 for

Q12: Parrot Inc.acquired an 85% interest in Sparrow

Q13: Patterson Company acquired 90% of Starr Corporation

Q14: On January 1,2011,Parry Incorporated paid $72,000 cash

Q17: Perth Corporation acquired a 100% interest in

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q19: Pardo Corporation paid $140,000 for a 70%

Q20: On January 1,2012,Packaging International purchased 90% of