Essay

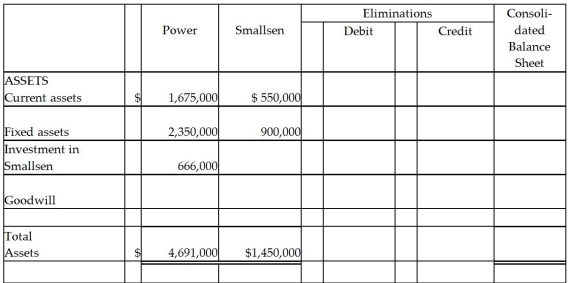

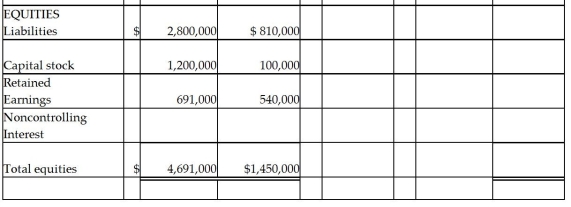

On January 2,2011,Power Incorporated paid $630,000 for a 90% interest in Smallsen Company.Smallsen's equity at that time amounted to $600,000,and their book values for assets and liabilities recorded approximated their fair values.Smallsen did not issue any additional stock in 2011.At December 31,2011,the two companies' balance sheets are summarized as follows:

Power Incorporated and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31,2011

Required: Complete the consolidation worksheet for Power Incorporated and Subsidiary at December 31,2011.

Required: Complete the consolidation worksheet for Power Incorporated and Subsidiary at December 31,2011.

Correct Answer:

Verified

Power Incorporated and Subsidi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: A subsidiary can be excluded from consolidation

Q6: Polaris Incorporated purchased 80% of The Solar

Q8: Pool Industries paid $540,000 to purchase 75%

Q9: Petra Corporation paid $500,000 for 80% of

Q10: The consolidated balance sheet of Pasker Corporation

Q12: Parrot Inc.acquired an 85% interest in Sparrow

Q13: Patterson Company acquired 90% of Starr Corporation

Q14: On January 1,2011,Parry Incorporated paid $72,000 cash

Q15: On January 1,2005,Myna Corporation issued 10,000 shares

Q45: Subsequent to an acquisition,the parent company and