Multiple Choice

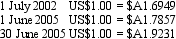

The net assets of a foreign operation at 30 June 2005 are constituted as assets of US$400,000 and liabilities of US$250,000.The parent entity purchased the foreign subsidiary on 1 July 2002.Exchange rate information is as follows:  The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

A) Foreign exchange gain $A197,185.

B) Foreign exchange gain $A20,610.

C) Foreign exchange gain $A342,310.

D) Foreign exchange loss $A6,002.

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The translation approach required by AASB 121

Q20: Distributions from retained profits are translated at<br>A)

Q21: Rudd Ltd,an Australian entity purchased Lee Ltd

Q22: Lennon Ltd has two foreign operations based

Q23: Aus Co Ltd has a foreign operation

Q24: Exchange differences resulting from the translation of

Q27: Under the translation method required by AASB

Q28: The exchange rate used for the translation

Q29: In the process of consolidating the translated

Q39: In translating the accounts of a foreign