Multiple Choice

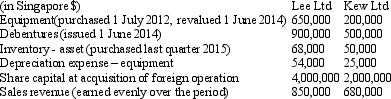

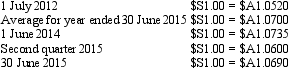

Rudd Ltd,an Australian entity purchased Lee Ltd and Kew Ltd on 1 July 2012.Both entities are considered foreign operations of Rudd Ltd based in Singapore.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2015:  Exchange rate information is:

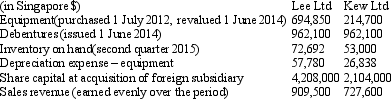

Exchange rate information is: The translation from Singapore dollars to Australian dollars resulted to the following balances:

The translation from Singapore dollars to Australian dollars resulted to the following balances: Which of the following translation processes were applied to Lee Ltd and Kew Ltd,respectively,for the year ended 30 June 2015?

Which of the following translation processes were applied to Lee Ltd and Kew Ltd,respectively,for the year ended 30 June 2015?

A) Functional currency; Presentation currency;

B) Functional currency; Functional currency;

C) Presentation currency; Functional currency;

D) Presentation currency; Presentation currency;

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: As prescribed in AASB 121,when re-measuring financial

Q17: The following is an extract from the

Q18: AASB 121 specifies that post-acquisition movements in

Q20: Distributions from retained profits are translated at<br>A)

Q22: Lennon Ltd has two foreign operations based

Q23: Aus Co Ltd has a foreign operation

Q24: Exchange differences resulting from the translation of

Q25: The net assets of a foreign operation

Q39: In translating the accounts of a foreign

Q48: AASB 121 requires foreign currency transactions to