Multiple Choice

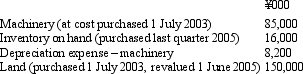

Aus Co Ltd has a foreign operation based in Japan.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2005:  Exchange rate information is:

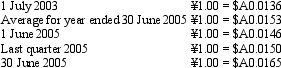

Exchange rate information is: What is the amount at which each item would be translated (rounded to the nearest $A) ?

What is the amount at which each item would be translated (rounded to the nearest $A) ?

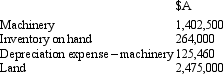

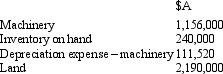

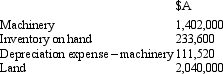

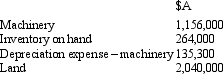

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: AASB 121 specifies that post-acquisition movements in

Q20: Distributions from retained profits are translated at<br>A)

Q21: Rudd Ltd,an Australian entity purchased Lee Ltd

Q22: Lennon Ltd has two foreign operations based

Q24: Exchange differences resulting from the translation of

Q25: The net assets of a foreign operation

Q27: Under the translation method required by AASB

Q28: The exchange rate used for the translation

Q39: In translating the accounts of a foreign

Q48: AASB 121 requires foreign currency transactions to