Multiple Choice

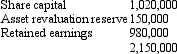

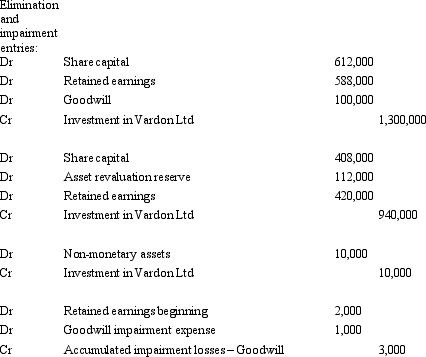

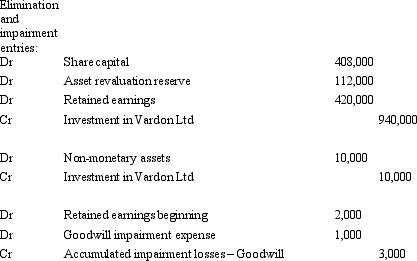

Dolly Ltd acquired a 60 per cent interest in Vardon Ltd on 1 July 2002 for a cash consideration of $1,300,000.At that date fair value of the net assets of Vardon Ltd were represented by:  On 1 July 2004 Dolly Ltd purchased the final 40 per cent of the issued capital of Vardon Ltd for cash consideration of $950,000.At this date the fair value of the net assets of Vardon Ltd were represented by:

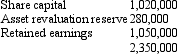

On 1 July 2004 Dolly Ltd purchased the final 40 per cent of the issued capital of Vardon Ltd for cash consideration of $950,000.At this date the fair value of the net assets of Vardon Ltd were represented by: Impairment of goodwill was assessed at $3,000; of which $2,000 related to the year ended 30 June 2005.There were no intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary and amortise goodwill for the period ended 30 June 2006?

Impairment of goodwill was assessed at $3,000; of which $2,000 related to the year ended 30 June 2005.There were no intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary and amortise goodwill for the period ended 30 June 2006?

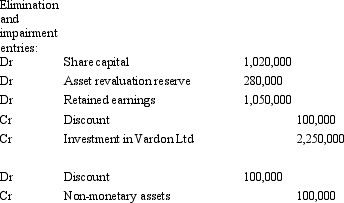

A)

B)

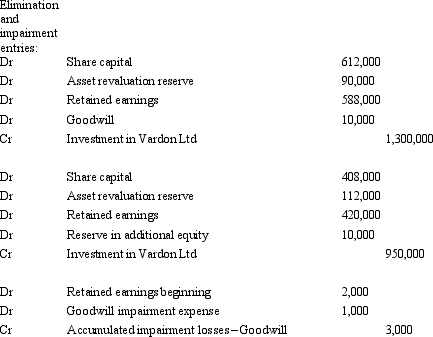

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: AASB 3 specifies that where a parent

Q3: The following consolidation adjusting journal entries appeared

Q4: Fan Ltd acquired a 60 per cent

Q5: Fish Ltd acquired an 80 per cent

Q6: On 1 July 2004,Horse Ltd acquired 80

Q7: The profit or loss on the sale

Q8: Which of the following is not a

Q9: AASB 127 "Consolidated and Separate Financial Statements"

Q10: When additional shares in a subsidiary are

Q11: Spock Ltd acquired a 10 per cent