Multiple Choice

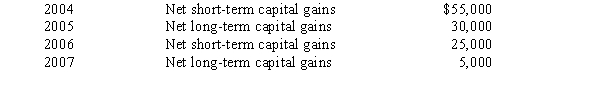

Bear Corporation has net short-term capital gains of $25,000 and net long-term capital losses of $170,000 during 2008.Bear Corporation had taxable income from other sources of $700,000.Prior years' transactions included the following:

Compute the amount of Bear's capital loss carryover to 2009.

A) $0.

B) $30,000.

C) $85,000.

D) $145,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Luis is the sole shareholder of Stork,Inc.,a

Q62: During 2008,Sparrow Corporation,a calendar year C corporation,had

Q63: Bass Corporation received a dividend of $80,000

Q64: Hippo,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q65: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q67: Cecelia is the sole shareholder of Aqua

Q68: On April 8,2008,Oriole Corporation donated a painting

Q69: During the year,Platinum Corporation (a calendar year

Q71: For a corporation,the domestic production activities deduction

Q100: Nicole owns and operates a sole proprietorship.She