Heron Corporation,a Calendar Year,accrual Basis Taxpayer,provides the Following Information for This

Essay

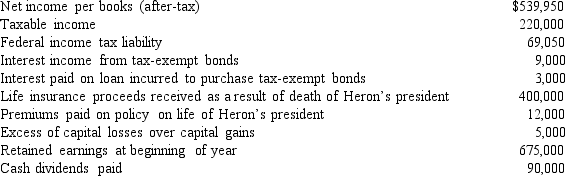

Heron Corporation,a calendar year,accrual basis taxpayer,provides the following information for this year and asks you to prepare Schedule M-1:

Correct Answer:

Verified

Net income per books...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Zircon Corporation donated scientific property worth $350,000

Q61: Luis is the sole shareholder of Stork,Inc.,a

Q62: During 2008,Sparrow Corporation,a calendar year C corporation,had

Q63: Bass Corporation received a dividend of $80,000

Q64: Hippo,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q66: Bear Corporation has net short-term capital gains

Q67: Cecelia is the sole shareholder of Aqua

Q68: On April 8,2008,Oriole Corporation donated a painting

Q69: During the year,Platinum Corporation (a calendar year

Q100: Nicole owns and operates a sole proprietorship.She