Essay

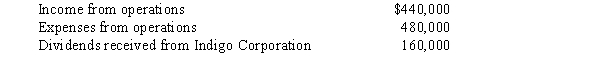

During the year,Platinum Corporation (a calendar year taxpayer)has the following transactions:

a.Platinum owns 18% of Brass Corporation's stock. What is Platinum's taxable income (loss) for the year?

b.What is the dividends received deduction if Platinum owned 75% of Brass Corporation's stock?

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Hippo,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q65: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q66: Bear Corporation has net short-term capital gains

Q67: Cecelia is the sole shareholder of Aqua

Q68: On April 8,2008,Oriole Corporation donated a painting

Q71: For a corporation,the domestic production activities deduction

Q72: Maize Corporation had $100,000 operating income and

Q74: Discuss the purpose of Schedule M-1.Give an

Q90: C corporations can elect fiscal years that

Q100: Nicole owns and operates a sole proprietorship.She