Multiple Choice

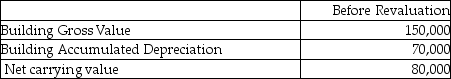

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?

A) $20,000 debit

B) $70,000 credit

C) $70,000 debit

D) $60,000 credit

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A company owns an office building that

Q53: Which statement is correct?<br>A)Vines are biological assets

Q94: What is "value in use"?<br>A)The present value

Q110: What is the recoverable amount for this

Q110: Which of the following is correct with

Q113: Smith Inc wishes to use the revaluation

Q115: Wilson Inc wishes to use the revaluation

Q117: Wilson Inc wishes to use the revaluation

Q119: Wallace Inc wishes to use the revaluation

Q120: Wilson Inc wishes to use the revaluation