Multiple Choice

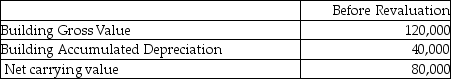

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

A) $60,000 debit to profit and loss

B) $60,000 credit to profit and loss

C) $60,000 debit to OCI

D) $60,000 credit to OCI

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A company owns an office building that

Q53: Which statement is correct?<br>A)Vines are biological assets

Q94: What is "value in use"?<br>A)The present value

Q110: Which of the following is correct with

Q110: What is the recoverable amount for this

Q113: Smith Inc wishes to use the revaluation

Q115: Wilson Inc wishes to use the revaluation

Q116: Wallace Inc wishes to use the revaluation

Q117: Wilson Inc wishes to use the revaluation

Q119: Wallace Inc wishes to use the revaluation