Multiple Choice

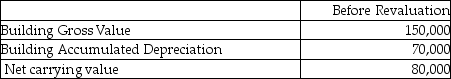

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?

A) $20,000 debit

B) $20,000 credit

C) $70,000 debit

D) $80,000 credit

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A company owns an office building that

Q53: Which statement is correct?<br>A)Vines are biological assets

Q94: What is "value in use"?<br>A)The present value

Q110: Which of the following is correct with

Q110: What is the recoverable amount for this

Q113: Smith Inc wishes to use the revaluation

Q115: Wilson Inc wishes to use the revaluation

Q116: Wallace Inc wishes to use the revaluation

Q117: Wilson Inc wishes to use the revaluation

Q120: Wilson Inc wishes to use the revaluation