Multiple Choice

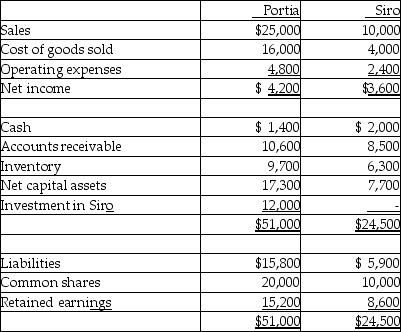

Portia Ltd.acquired 80% of Siro Ltd.on December 31,20X0.At the date of acquisition,Siro's net assets totalled $15,000.Portia uses the cost method to record the acquisition.At December 31,20X1,the separate-entity financial statements showed the following:

During 20X1,Siro sold $7,000 of goods,with a gross margin of 40%,to Portia.At the end of 20X1,$3,000 of the goods were still in Portia's inventory.What portion of consolidated net income for 20X1 is attributable to Portia?

A) $6,120

B) $6,240

C) $6,600

D) $7,080

Correct Answer:

Verified

Correct Answer:

Verified

Q8: What is the purpose of showing an

Q26: On December 31,20X2,Bates Ltd.purchased 75% of the

Q28: Bates Ltd.owns 60% of the outstanding common

Q29: Portia Ltd.acquired 80% of Siro Ltd.on December

Q30: Which consolidation method does not include incorporating

Q31: On December 31,20X5,Paper Co.purchased 60% of the

Q32: On December 31,20X2,the Esther Company purchased 80%

Q33: On December 31,20X6,the statements of financial position

Q34: Taguchi Ltd.owns 80% of Shag Co.Shag declared

Q35: How is the consolidated ending retained earnings