Multiple Choice

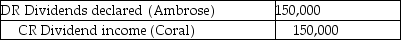

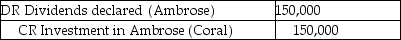

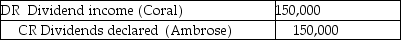

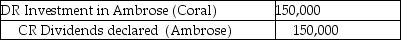

Coral Ltd.owns 100% of Ambrose Ltd.Coral uses the cost method to record this subsidiary.Coral received $150,000 in dividends from Ambrose.What journal entry should Coral make on its consolidation worksheet with respect to the dividends?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Mitzy's Muffins Ltd.purchased a commercial baking system

Q26: A parent company can record an investment

Q27: DIY Ltd.owns 20 subsidiary companies.Most of the

Q28: On January 1,20X3,Dwayne Ltd.formed Carlos Co. ,a

Q30: On September 1,20X5,CanAir Limited decided to buy

Q31: On December 31,20X5,Space Co.purchased 100% of the

Q32: In 20X1,a parent company sold a tract

Q33: On December 31,20X5,Space Co.purchased 100% of the

Q34: On December 31,20X2,the Pipe Ltd.purchased 100% of

Q36: A company has a subsidiary that has