Essay

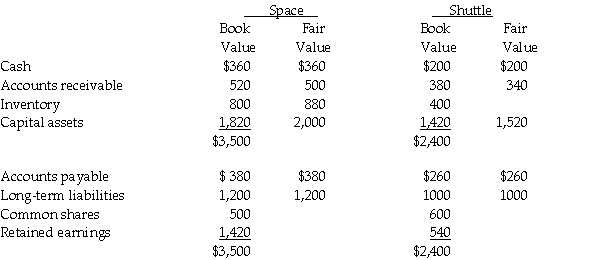

On December 31,20X5,Space Co.purchased 100% of the outstanding common shares of Shuttle Ltd.for $1,200,000 in shares and $200,000 in cash.The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Shuttle relates to its office building.This building was originally purchased by Shuttle in January,20X1 and is being depreciated over 30 years.

During 20X6,the year following the acquisition,the following occurred:

1.Shuttle borrowed $350,000 from Space on June 1,20X6,and was charged interest at 10% per annum,which it paid on a monthly basis.There were no repayments of principal made during the remaining of the year.

2.Throughout the year,Shuttle purchased merchandise of $800,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $250,000 on this merchandise.75% of this merchandise was resold by Shuttle prior to December 31,20X6.

3.Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

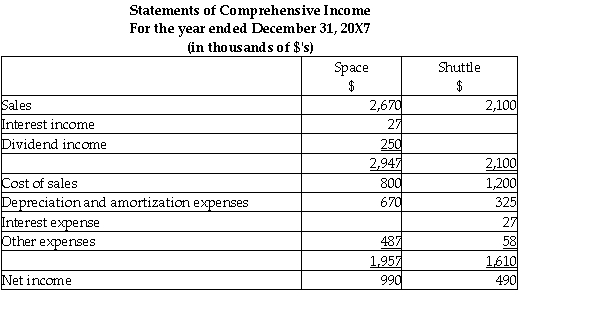

During 20X7,the following occurred:

1.Shuttle paid $150,000 on the loan payable to Space on May 30,20X7.

2.Throughout the year,Shuttle purchased merchandise of $1,000,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $150,000 on this merchandise.85% of this merchandise was resold by Shuttle prior to December 31,20X7.

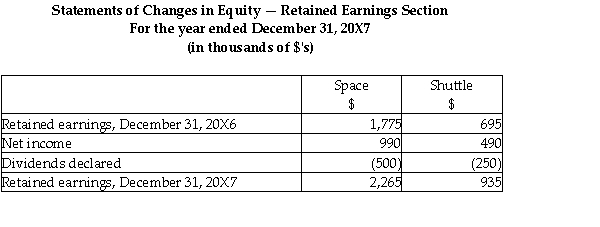

3.Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.

Required:

Calculate the consolidated retained earnings for Space as at December 31,20X7.

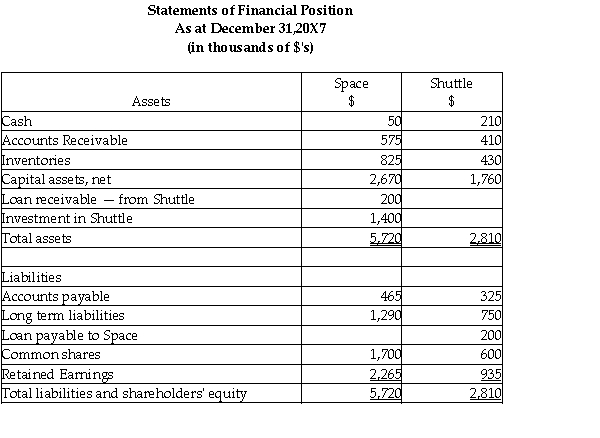

Prepare the consolidated statement of financial position for the year ended December 31,20X7 for Space.

Correct Answer:

Verified

Measurement: Calculation of goodwill (in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Piri Ltd. acquired 100% of the commons

Q26: A parent company can record an investment

Q27: DIY Ltd.owns 20 subsidiary companies.Most of the

Q28: On January 1,20X3,Dwayne Ltd.formed Carlos Co. ,a

Q29: Coral Ltd.owns 100% of Ambrose Ltd.Coral uses

Q30: On September 1,20X5,CanAir Limited decided to buy

Q32: In 20X1,a parent company sold a tract

Q33: On December 31,20X5,Space Co.purchased 100% of the

Q34: On December 31,20X2,the Pipe Ltd.purchased 100% of

Q36: Franklin Ltd. ,a subsidiary of Frayer Ltd.