Multiple Choice

In 20X1,a parent company sold a tract of land to its subsidiary for $100,000,resulting in a $30,000 loss.The subsidiary's plans for the land did not materialize and it still owned the land at the end of 20X4.At the end of 20X4,what consolidating journal entry should be made with respect to the loss associated with the sale of land?

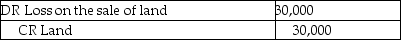

A)

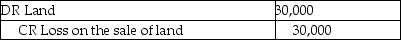

B)

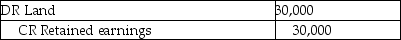

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Piri Ltd. acquired 100% of the commons

Q26: Fair value increments on depreciable assets _.<br>A)should

Q27: DIY Ltd.owns 20 subsidiary companies.Most of the

Q28: On January 1,20X3,Dwayne Ltd.formed Carlos Co. ,a

Q29: Coral Ltd.owns 100% of Ambrose Ltd.Coral uses

Q30: On September 1,20X5,CanAir Limited decided to buy

Q31: On December 31,20X5,Space Co.purchased 100% of the

Q33: On December 31,20X5,Space Co.purchased 100% of the

Q34: On December 31,20X2,the Pipe Ltd.purchased 100% of

Q36: Franklin Ltd. ,a subsidiary of Frayer Ltd.