Multiple Choice

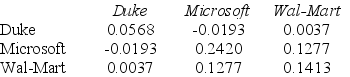

Use the table for the question(s) below.

Consider the following covariances between securities:

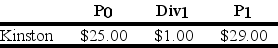

-Suppose you have $10,000 in cash to invest. You decide to sell short $5,000 worth of Kinston stock and invest the proceeds from your short sale, plus your $10,000 into one-year U.S. treasury bills earning 5%. At the end of the year, you decide to liquidate your portfolio. Kinston Industries has the following realized returns:  The return on your portfolio is closest to:

The return on your portfolio is closest to:

A) -0.5%

B) 13.5%

C) -2.5%

D) 14.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Use the table for the question(s)below.<br>Consider the

Q4: Use the information for the question(s)below.<br>Suppose that

Q14: Use the table for the question(s)below.<br>Consider the

Q15: Use the information for the question(s)below.<br>Suppose that

Q35: Which of the following statements is FALSE?<br>A)Margin

Q58: Use the information for the question(s)below.<br>Suppose you

Q97: Use the table for the question(s) below.<br>Consider

Q116: Use the information for the question(s)below.<br>You are

Q124: Use the information for the question(s)below.<br>Suppose that

Q128: Use the following information to answer the