Multiple Choice

Table 12.2

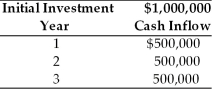

A firm is considering investment in a capital project which is described below. The firm's cost of capital is 18 percent and the risk-free rate is 6 percent. The project has a risk index of 1.5. The firm uses the following equation to determine the risk adjusted discount rate, RADR, for each project: RADR = Rf + Risk Index (Cost of capital - Rf)

-The net present value of the project when adjusting for risk is ________. (See Table 12.2)

A) -$9,500

B) $0

C) $87,000

D) $105,000

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Table 12.5<br>Nico Manufacturing is considering investment in

Q29: In case of unequal-lived, mutually exclusive projects,

Q30: Table 12.5<br>Nico Manufacturing is considering investment in

Q31: Scenario analysis is a behavioral approach that

Q32: In a capital budgeting context, risk is

Q36: Table 12.6<br>Yong Importers, an Asian import company,

Q36: Table 12.5<br>Nico Manufacturing is considering investment in

Q37: Tangshan Mining Company, with a cost of

Q38: Risk-adjusted discount rates (RADRs) are the risk-adjustment

Q55: The higher the risk of a project,