Multiple Choice

Austin incurs $3,600 for business meals while traveling for his employer,Tex,Inc.Austin is reimbursed in full by Tex pursuant to an accountable plan.What amounts can Austin and Tex deduct?

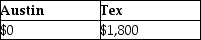

A)

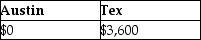

B)

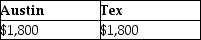

C)

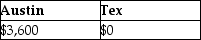

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Educational expenses incurred by a bookkeeper for

Q25: Educational expenses incurred by a CPA for

Q33: If an individual is self-employed,business-related expenses are

Q38: Deductible moving expenses include the cost of

Q122: Gwen traveled to New York City on

Q125: Sam retired last year and will receive

Q127: West's adjusted gross income was $90,000.During the

Q128: Tyler (age 50)and Connie (age 48)are a

Q129: Edward incurs the following moving expenses: <img

Q135: Steven is a representative for a textbook