Multiple Choice

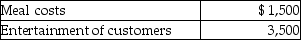

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

A) $500 from AGI

B) $500 for AGI

C) $2,000 from AGI

D) $2,000 for AGI

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Educational expenses incurred by a bookkeeper for

Q25: Educational expenses incurred by a CPA for

Q33: If an individual is self-employed,business-related expenses are

Q38: Deductible moving expenses include the cost of

Q122: Gwen traveled to New York City on

Q125: Sam retired last year and will receive

Q127: West's adjusted gross income was $90,000.During the

Q128: Tyler (age 50)and Connie (age 48)are a

Q129: Edward incurs the following moving expenses: <img

Q134: Austin incurs $3,600 for business meals while