Essay

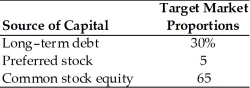

A firm has determined its optimal capital structure,which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value.The stock will pay an $8.00 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share.The dividend expected to be paid at the end of the coming year is $5.07.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.45.It is expected that to sell,a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The Gordon model is based on the

Q6: Since retained earnings are viewed as a

Q10: The after-tax cost of debt for a

Q11: The four basic sources of long-term funds

Q11: A firm has common stock with a

Q14: The _ is the firm's desired optimal

Q36: Using the capital asset pricing model, the

Q66: A firm has determined it can issue

Q71: Table 9.1<br>A firm has determined its optimal

Q123: The amount of preferred stock dividends that