Essay

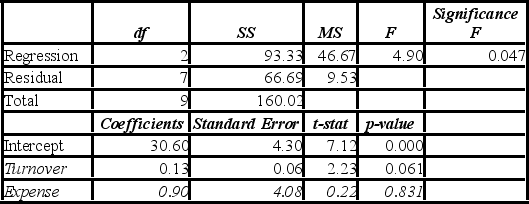

An investment analyst wants to examine the relationship between a mutual fund's return, its turnover rate, and its expense ratio. She randomly selects 10 mutual funds and estimates: Return = β0 + β1Turnover + β2Expense + ε, where Return is the average five-year return (in %), Turnover is the annual holdings turnover (in %), Expense is the annual expense ratio (in %), and ε is the random error component. A portion of the regression results is shown in the accompanying table.  a. At the 10% significance level, are the explanatory variables jointly significant in explaining Return? Explain.

a. At the 10% significance level, are the explanatory variables jointly significant in explaining Return? Explain.

B) At the 10% significance level, is each explanatory variable individually significant in explaining Return? Explain.

Correct Answer:

Verified

a. Here the competing hypotheses for a j...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A researcher gathers data on 25 households

Q2: A real estate analyst believes that the

Q3: When testing r linear restrictions imposed on

Q4: When estimating y = β<sub>0</sub> + β<sub>1</sub>x<sub>1</sub>

Q6: Multicollinearity is suspected when _.<br>A) there is

Q7: A marketing analyst wants to examine the

Q8: In regression, the predicted values concerning y

Q9: Refer to the portion of regression results

Q10: Conditional on x<sub>1</sub>, x<sub>2</sub>, ..., x<sub>k</sub>, the

Q11: Consider the following simple linear regression model: