Multiple Choice

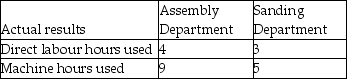

Bond Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Assembly and Sanding.The Assembly Department uses a departmental overhead rate of $20 per machine hour,while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour.Job 542 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.

What was the total cost of Job 542 if Bond Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,375

B) $1,425

C) $1,500

D) $1,600

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Step-Up Corporation manufactures two small step ladders,Regular

Q4: Hinckley & Granger Company had the following

Q6: Silver Company manufactures several different products and

Q8: Jason Corporation uses activity-based costing.The company produces

Q10: Traditions Home Accessories Company manufactures pillows using

Q49: It is easier to allocate indirect costs

Q74: Two main benefits of ABC are (1)more

Q85: Clearview Display Company manufactures display cases to

Q132: Facility-level activities and costs are incurred no

Q169: The benefits of ABC/ABM are higher when