Essay

Step-Up Corporation manufactures two small step ladders,Regular and Deluxe.Deluxe ladders were added as a product line three years ago.Deluxe ladders are the more complex of the two products as they are extendable,requiring one hour of direct labour time per unit to manufacture,compared to one-half hours of direct labour time for Regular ladder.

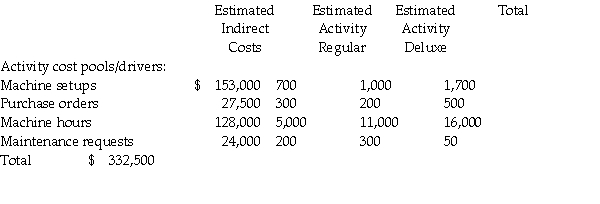

Indirect costs are currently allocated to the products on the basis of direct labour hours.The company estimated it would incur $332,500 in manufacturing overhead costs and produce 6,000 units of Deluxe ladders and 20,000 units of Regular ladders during the current year.

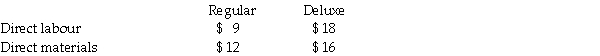

Unit costs for materials and direct labour are:

Indirect costs are:

Required:

a.Determine the unit cost of the two products using traditional costing with units as the allocation base.

b.Determine the unit cost of the two products using activity-based costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Hinckley & Granger Company had the following

Q5: Bond Industries uses departmental overhead rates to

Q6: Silver Company manufactures several different products and

Q8: Jason Corporation uses activity-based costing.The company produces

Q10: Traditions Home Accessories Company manufactures pillows using

Q49: It is easier to allocate indirect costs

Q74: Two main benefits of ABC are (1)more

Q85: Clearview Display Company manufactures display cases to

Q132: Facility-level activities and costs are incurred no

Q169: The benefits of ABC/ABM are higher when