Essay

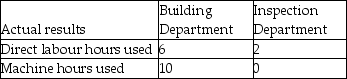

Leonard Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Building and Inspection.The Building Department uses a departmental overhead rate of $18 per machine hour,while the Inspection Department uses a departmental overhead rate of $15 per direct labour hour.Job 611 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 611 is $1,500.

What was the total cost of Job 611 if Leonard Industries used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

_TB1765_00_TB1765_00...

_TB1765_00_TB1765_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: The use of which of the following

Q82: Hinckley & Granger Company had the following

Q83: Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The

Q86: Menno Corporation manufactures two products-Tables and Chairs.The

Q87: Jason Corporation uses activity-based costing.The company produces

Q89: Red Stone Manufacturing,a manufacturer of a variety

Q145: Value-added activities can be described as activities

Q150: Which of the following describes how, in

Q180: The four categories of activity costs in

Q182: The benefits are lower when ABC reports