Multiple Choice

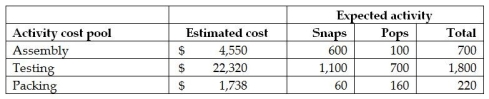

Jason Corporation uses activity-based costing.The company produces two products: Snaps and Pops.The expected annual production of Snaps is 1,000 units,while the expected annual production of Pops is 3,000 units.There are three activity cost pools: Assembly,Testing,and Packing.The estimated costs and activities for each of these three activity pools follows:

The cost pool activity rate for Testing would be

A) $12.40 per activity.

B) $20.29 per activity.

C) $31.89 per activity.

D) $5.58 per activity.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The use of which of the following

Q57: When calculating a departmental overhead rate, the

Q82: Hinckley & Granger Company had the following

Q83: Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The

Q83: If a company uses departmental overhead allocation

Q84: Leonard Industries uses departmental overhead rates to

Q86: Menno Corporation manufactures two products-Tables and Chairs.The

Q89: Red Stone Manufacturing,a manufacturer of a variety

Q108: Cost distortion results in the<br>A) overcosting of

Q180: The four categories of activity costs in