Multiple Choice

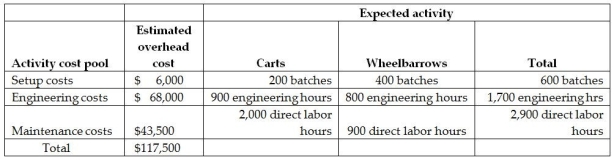

Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The annual production and sales of Carts is 2,000 units,while 1,800 units of Wheelbarrows are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Carts require 1.0 direct labour hours per unit,while Wheelbarrows require 0.5 direct labour hours per unit.The total estimated overhead for the period is $117,500.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The overhead cost per Wheelbarrow using an activity-based costing system would be closest to

A) $27.50.

B) $65.00.

C) $65.28.

D) $24.75.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The use of which of the following

Q82: Hinckley & Granger Company had the following

Q84: Leonard Industries uses departmental overhead rates to

Q86: Menno Corporation manufactures two products-Tables and Chairs.The

Q87: Jason Corporation uses activity-based costing.The company produces

Q90: A departmental overhead rate is calculated by

Q145: Value-added activities can be described as activities

Q150: Which of the following describes how, in

Q180: The four categories of activity costs in

Q182: The benefits are lower when ABC reports