Multiple Choice

Use the following information to answer the question(s) below..

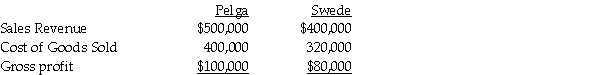

Pelga Company routinely receives goods from its 80%-owned subsidiary,Swede Corporation.In 2014,Swede sold merchandise that cost $80,000 to Pelga for $100,000.Half of this merchandise remained in Pelga's December 31,2014 inventory.This inventory was sold in 2015.During 2015,Swede sold merchandise that cost $160,000 to Pelga for $200,000.$62,500 of the 2015 merchandise inventory remained in Pelga's December 31,2015 inventory.Selected income statement information for the two affiliates for the year 2015 was as follows:

-Shalles Corporation,a 80%-owned subsidiary of Pani Corporation,sold inventory items to its parent at a $48,000 profit in 2014.Pani resold one-third of this inventory to outside entities.Shalles reported net income of $200,000 for 2014.Noncontrolling interest share of consolidated net income that will appear in the income statement for 2014 is

A) $30,400.

B) $32,000.

C) $33,600.

D) $40,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Phast Corporation owns a 80% interest in

Q16: Presented below are several figures reported for

Q17: Use the following information to answer the

Q19: Use the following information to answer the

Q22: Use the following information to answer the

Q25: Assume there are routine inventory sales between

Q28: Use the following information to answer the

Q29: Use the following information to answer the

Q34: Psalm Enterprises owns 90% of the outstanding

Q44: Salli Corporation regularly purchases merchandise from their