Essay

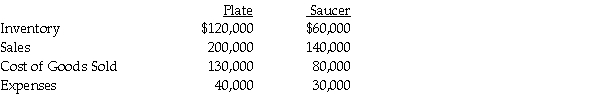

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2014.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2013,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2013,but was sold in 2014.In 2014,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2014.

Required: Calculate following balances at December 31,2014.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Phast Corporation owns a 80% interest in

Q14: Use the following information to answer the

Q17: Use the following information to answer the

Q20: Preen Corporation acquired a 60% interest in

Q21: Pastern Industries has an 80% ownership stake

Q22: Use the following information to answer the

Q28: Use the following information to answer the

Q29: Use the following information to answer the

Q34: Psalm Enterprises owns 90% of the outstanding

Q44: Salli Corporation regularly purchases merchandise from their