Essay

Plover Corporation acquired 80% of Sink Inc.equity on January 1,2013,when the book values of Sink's assets and liabilities were equal to their fair values.The cost of the investment was equal to 80% of the book value of Sink's net assets.

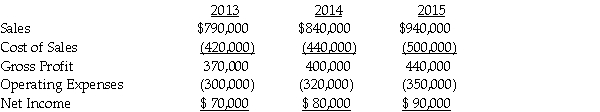

Plover separate income (excluding Sink)was $1,800,000,$1,700,000 and $1,900,000 in 2013,2014 and 2015 respectively.Plover sold inventory to Sink during 2013 at a gross profit of $48,000 and one quarter remained at Sink at the end of the year.The remaining 25 percent was sold in 2014.At the end of 2014,Plover has $25,000 of inventory received from Sink from a sale of $100,000 which cost Sink $80,000.There are no unrealized profits in the inventory of Plover or Sink at the end of 2015.Plover uses the equity method in its separate books.Select financial information for Sink follows:

Required:

Prepare a schedule to determine the controlling interest share of the consolidated net income for 2013,2014,and 2015.

Correct Answer:

Verified

2013 Noncontrolling interest...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2013 Noncontrolling interest...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Preen Corporation acquired a 60% interest in

Q21: Pastern Industries has an 80% ownership stake

Q22: Use the following information to answer the

Q23: A parent company regularly sells merchandise to

Q25: Pittle Corporation acquired a 80% interest in

Q26: Proman Manufacturing owns a 90% interest in

Q28: Paulee Corporation paid $24,800 for an 80%

Q29: Peel Corporation acquired a 80% interest in

Q37: Use the following information to answer the

Q38: On January 1,2014,Plastam Industries acquired an 80%